Ups and downs of central bank independence from the Great Inflation to the Great Recession: theory, institutions and empirics

🏛️ Central Bank Independence: Evolution and Impact

🏛️ Central Bank Independence: Evolution and ImpactAbstract

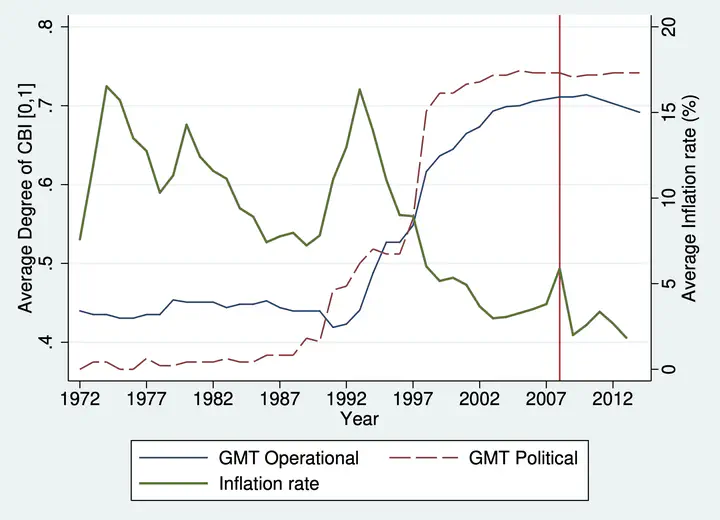

This article analyses the pillar of modern central bank governance, i.e. central bank independence, from three perspectives. First, we provide a systematic review of the economics of central bank independence. Second, applying a principal agent model we design a political economy framework, which explains how politicians can shape central bank governance in addressing macroeconomic shocks, while taking into account both the wishes of the citizens and their own personal interests. This framework is then used to interpret the evolution of central bank independence from the Great Inflation (1970s), throughout the Great Moderation (1980s-2000s) and to the Great Recession (2007-14). We provide empirical evidence supporting this evolution using recently developed indices of dynamic central bank independence. Further, our findings stress the importance of macroeconomic shocks in shaping the evolution of central bank independence after the global financial crisis.